Coordinating Regulatory Frameworks for Crypto-Assets

“Pathways to the Regulation of Crypto-Assets: A Global Approach” by the World Economic Forum was released in May 2023. Read our take from the Report below.

Image: WEF

How Best to Regulate Something That’s Decentralized and Constantly Evolving?

Coordinating regulatory frameworks across jurisdictions has always been a complex task, but it becomes even more challenging in the case of crypto-assets due to their unique features and boundless opportunities. Many argue that global coordination is not only desirable but necessary in order to effectively address the complexities of this rapidly evolving sector.

The latest white paper from the World Economic Forum explores the reasons why a global approach is warranted, the barriers that hinder its realization, and the efforts made by international bodies and organizations to develop a unified regulatory framework.

The Need for Global Coordination

Borderless nature of technology: As the crypto-asset ecosystem evolves from centralized to decentralized systems, it becomes increasingly difficult to identify the "who," "where," and "whom" involved. This borderless nature of technology poses significant challenges to regulatory authorities.

Interconnectedness within the crypto-asset ecosystem and traditional financial system: Recent events have demonstrated the high level of interconnectedness within the crypto-asset environment. Fragmented regulatory regimes can hinder efforts to ensure uniform consumer protections and maintain market integrity. Considering the potential for integration with the traditional financial system, a collaborative approach becomes even more essential.

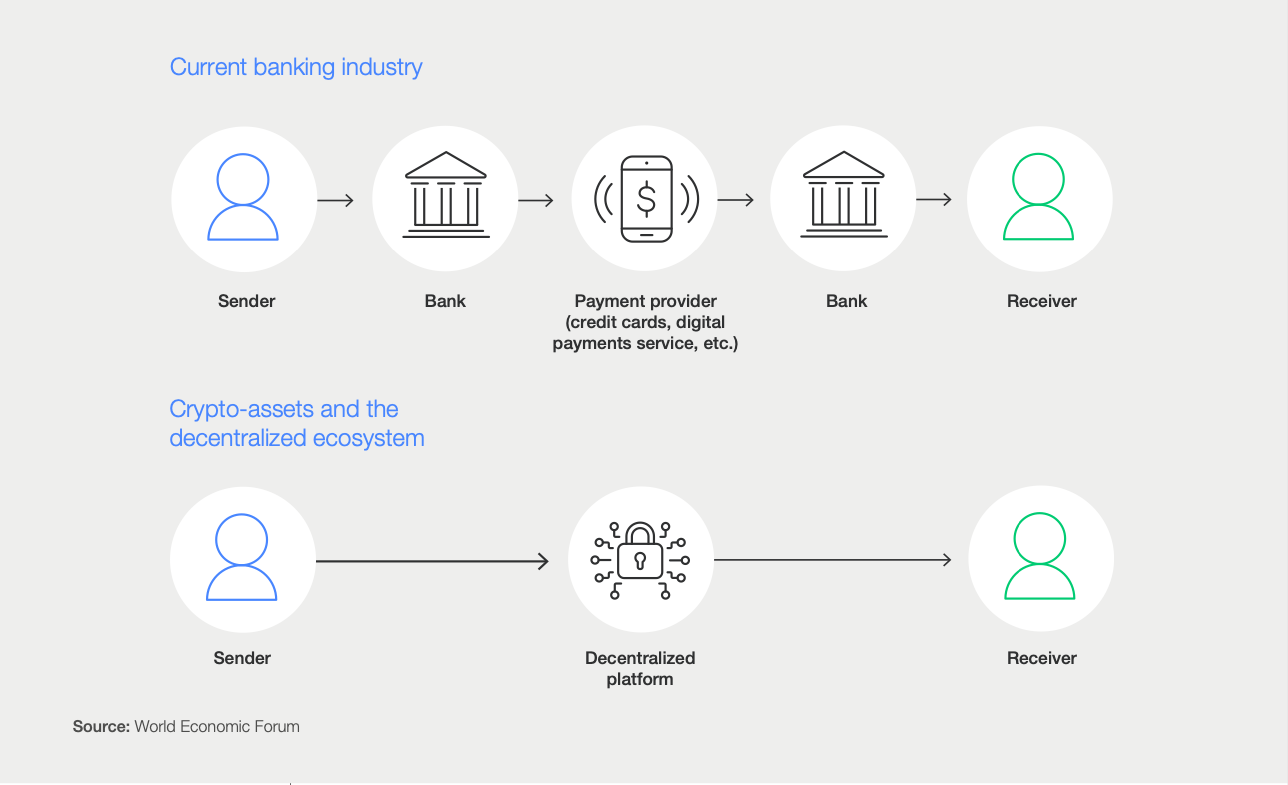

Intermediated flows of funds in traditional banking compared to peer-to-peer flows of funds in a decentralized system

Source: WEF

Barriers to Global Coordination

● Lack of harmonized taxonomies/classification: Different jurisdictions categorize and define crypto-assets differently, leading to ambiguity and a lack of clarity for market participants regarding risks and regulations.

● Regulatory arbitrage: Evolving regulatory frameworks in different jurisdictions create opportunities for regulatory arbitrage, making effective oversight and ecosystem development more challenging.

● Fragmented monitoring, supervision, and enforcement: The lack of coordination among law enforcement agencies results in inconsistent enforcement practices and regulatory approaches.

Efforts for a Global Approach

International standard-setting bodies and organizations have made significant efforts to develop evidence-based research and high-level frameworks for a global approach. Some countries have also focused on specific aspects of the ecosystem to ensure consumer protection, prevent illicit financing, and maintain financial stability. The paper discusses jurisdiction examples that showcase various regulatory approaches, including principle-based, risk-based, agile regulation, self and co-regulation, and regulation by enforcement.

Recommendations for Global Collaboration

To achieve a broad and global perspective on regulating crypto-assets, the Digital Currency Governance Consortium engaged diverse stakeholders. The resulting recommendations are intended for international organizations, national/regional authorities, and industry stakeholders. Additionally, academia, civil society, and users play crucial roles in the development of a responsible ecosystem. The recommendations acknowledge the need for an innovative approach while drawing from lessons learned and best practices from other sectors.

Conclusion

Coordinating regulatory frameworks for crypto-assets on a global scale is a complex task that requires collaboration and harmonization among jurisdictions. Despite the barriers and challenges, international efforts and recommendations from diverse stakeholders aim to evolve a responsible ecosystem. By addressing the unique opportunities and risks presented by crypto-assets while incorporating lessons from other sectors, a global regulatory framework can foster stability, consumer protection, and market integrity in the rapidly evolving crypto-asset landscape.

Key Points:

● A global approach is necessary to maximize the benefits and manage risks in the crypto-asset ecosystem.

● Different market maturity levels and regional hubs call for a holistic focus on the role of international organizations, regulators, and industry actors.

● Recommendations prioritize pathways for international organizations, national/regional regulators, and industry stakeholders.

● Examples and best practices from other sectors can guide the evolving regulatory approaches in the crypto-asset ecosystem.

● Civil society, academia, and users play critical roles in ensuring responsible development of the ecosystem.

● Cooperation and collaboration between international standard-setting bodies, regional authorities, national governments, and industry stakeholders are crucial.

● Recommendations aim to address technological, legal, regulatory, and supervisory challenges in the crypto-asset space.

Further read: MiCA - the EU crypto regulation.