Crypto Trends in Business & Beyond – Key Findings (2023)

Ripple’s Crypto Report

The crypto industry is constantly changing due to various factors, such as shifting global economies, the rise and fall of stablecoins, and significant events like the collapse of exchanges and major banks. Despite the challenges faced in 2022 and the rocky start to 2023 for the broader financial sector, global confidence in crypto and blockchain technology has increased. This change is driven by growing consumer demand, interest in blockchain, maturing use cases for financial institutions and businesses, and a shift towards real-world utility.

This report from Ripple focuses on the awareness, interest, and exploration of crypto by global finance leaders. It examines the value of crypto in decentralized finance (DeFi), tokenization, non-fungible tokens (NFTs), central bank digital currencies (CBDCs), payments, custody, and compliance. The goal is to understand the practical business value that crypto provides and how these technologies are converging to offer holistic and interoperable solutions.

The global finance landscape is evolving towards a future where value moves as seamlessly as information in what is called the Internet of Value. The report aims to help companies and financial institutions identify, define, and demystify key topics and technologies, providing insights into the problems and pain points that these technologies can address. It serves as a guide for understanding the everyday business value of crypto. The report emphasizes that the real potential of building with crypto is just beginning.

Enterprise finance leaders see cryptocurrency having the biggest impact on finance and technology.

Image: Ripple

The Future of Tokenization

This year's report focuses primarily on two token types: NFTs (Non-fungible tokens) and CBDCs (central bank digital currencies). While the initial hype around NFTs in the art and digital collectibles space is fading, the study confirms that real-world business applications of NFT technology are emerging and driving tangible value at present. When combined with other blockchain and crypto applications like decentralized identity and DeFi (Decentralized Finance), tokenization offers extensive opportunities for businesses. However, it is still an early stage, and there is much to explore and discover.

CBDC solutions have also gained significant traction, as evidenced by countries of all sizes piloting and exploring the technology. CBDCs have found product-market fit and are being tested globally. While achieving goals such as accelerated payments, reduced energy consumption, sustainable economies, and improved financial inclusion may take time, finance leaders remain optimistic that the technology can meet these high expectations.

Although challenges persist, including concerns about privacy/security and the need for regulatory clarity, the adoption trends for tokenization and CBDC solutions are promising. There is ample opportunity to educate and empower banks, financial institutions, governments, and businesses about the impact, importance, and real-world utility of these technologies. By doing so, we can foster continued growth and facilitate the widespread adoption of tokenization and CBDC solutions.

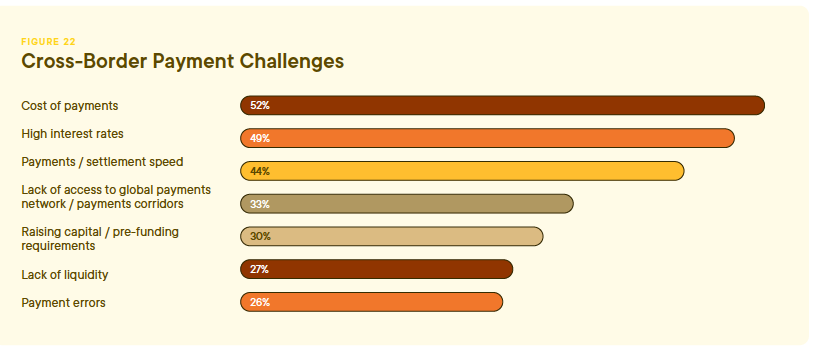

Challenges around current cross-border payment practices.

Image: Ripple

Managing Digital Value

Managing digital value encompasses various complexities, but by leveraging the right technology, partners, and solutions, financial institutions and enterprises can reap numerous benefits through the adoption of DeFi (Decentralized Finance) protocols and practices.

In this section, Ripple’s report emphasizes that finance leaders worldwide are taking notice and actively integrating or exploring DeFi and digital asset services within their organizations. Whether it's for borrowing and lending, accepting crypto payments, or hedging against inflation and foreign exchange risks, institutional DeFi offers opportunities for organizational excellence and enhanced customer experiences.

However, this area presents significant learning opportunities for the industry as a whole. There is a need for technical advancements in decentralized identity, zk-proofs (zero-knowledge proofs), and crypto custody. Moreover, regulatory clarity for crypto assets is a recurring theme that underlies the next section of this report.

As we progress, it becomes evident that the industry must navigate the complexities of both technical and regulatory aspects to fully harness the potential of DeFi.

Transactions with Digital Assets

The adoption of crypto-enabled payments is no longer a matter of if but when for financial institutions, enterprises, and their customers. Crypto payments are being utilized across various domains, including internal treasury operations, lending and borrowing, accepting donations, and payroll and distribution. In nearly every aspect of payments, crypto is currently in use or expected to be integrated in the near future.

To retain customers, drive revenue growth, and gain a competitive advantage in the modern, always-on economy, multinational companies require access to seamless, cost-effective cross-border payments and real-time settlement. These solutions should address pain points such as expensive payments, high interest rates, and limited liquidity while also providing access to new markets for customer expansion and scalability.

While solution providers can offer improved ways of moving value, broader global adoption of crypto for payments hinges on regulatory clarity. Encouragingly, progress has been made in several countries and regions, including the UK, EU, UAE, Japan, Mauritius, and Switzerland. Governments and policymakers at the national and international levels must continue to collaborate and establish clear regulations for crypto. Without regulatory clarity, the potential for further progress and innovation in the field is inadvertently impeded.

Conclusion

The belief in the significant impact of crypto and blockchain technology on business, finance, and society in the next three years is widely held by global finance decision makers, with over 88% sharing this sentiment. This conviction is even stronger among those in innovation-related roles at financial institutions, as reported by 100% of respondents. This recognition of crypto's potential reinforces its position within the financial sector, which is ripe for innovation and transformation.

The major theme revolves around the promise and potential of crypto and blockchain technology to revolutionize the financial system, addressing its current inefficiencies, opacity, and inequities. By leveraging these technologies, the aim is to enhance accessibility, improve efficiency, reduce costs, and bring financial services to the unbanked population. Furthermore, the financial sector represents a massive untapped opportunity for blockchain, with the lending and borrowing market alone estimated to be worth trillions of dollars.

Wrapping Up

You can find the key points of the crypto report below:

● The majority of global finance decision-makers believe that crypto and blockchain technology will have a significant or massive impact by 2026.

● Financial systems suffer from inefficiency, opacity, and high costs, leading to limited accessibility to basic financial services and protracted cross-border transactions.

● Finance represents a vast untapped opportunity for blockchain technology, with institutional DeFi penetration in this market currently below 0.1%.

● Despite the fall of major financial players, the industry has seen increased CBDC pilots, growing adoption of crypto-enabled payments, and the expanding real-world utility of tokenization.

● Companies like Ripple are developing solutions that bridge various technologies and applications, offering holistic and interoperable solutions that are secure, compliant, and user-friendly.

● Crypto and blockchain technology continue to innovate and gain adoption, with anticipated profound impacts in the future, especially with clear regulations and compliance guidance across jurisdictions.

● Building the Internet of Value is an ongoing endeavor, and the exploration of emerging functionalities and applications remains a focus for the future.