How can the European Venture Capital Industry Catch Up with the US? IMF Report Summary

The venture capital (VC) industry plays a critical role in fueling innovation, particularly in the tech sector. By providing not only financial resources but also expertise and networks, venture capitalists enable startups to grow and succeed, ultimately driving economic growth and technological advancement.

In Europe, however, the venture capital ecosystem is significantly underdeveloped compared to the United States, limiting the potential for startups to scale and achieve the kind of success that fosters widespread economic benefits.

The International Monetary Fund (IMF) report, "Stepping Up Venture Capital to Finance Innovation in Europe," highlights the stark contrast between the VC landscapes of the EU and the US.

Over the past decade, VC investments in the EU have averaged only 0.3 percent of GDP per year, compared to nearly three times that in the US.

This disparity is not just about capital; it reflects deeper issues related to market fragmentation, regulatory challenges, and a less developed ecosystem that makes it difficult for innovative European startups to scale and thrive.

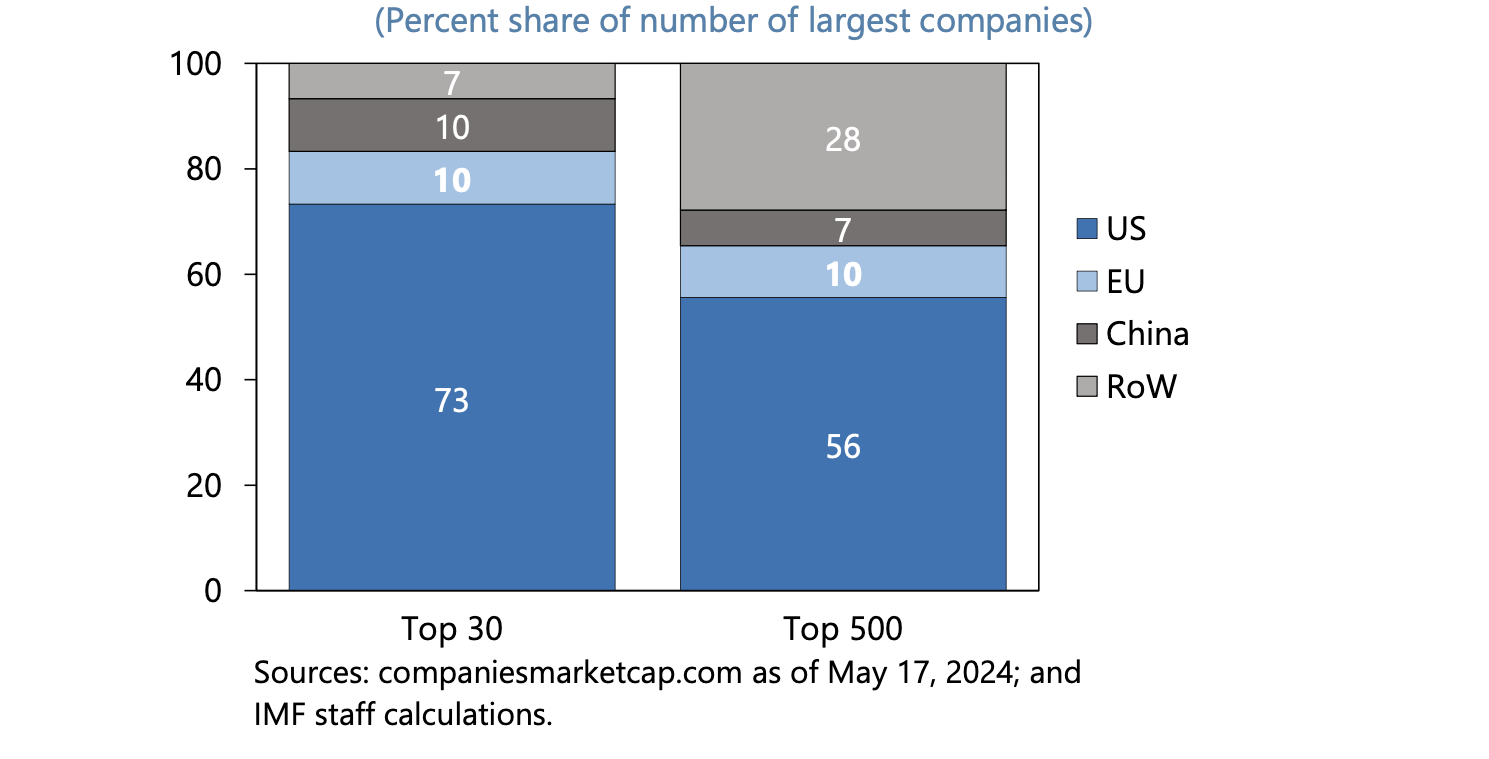

Nationality of Largest High-Tech Firms by Market Capitalization (Percent share of number of largest companies)

Source: IMF

Why is there so much difference between the European and the American venture capital industries? Key findings of the report indicate the following:

Structural Barriers: Europe's financial system, heavily bank-based, is less suited to funding high-risk, high-tech startups. Banks' lending models, focused on tangible collateral and profitability, do not align well with the needs of startups, which often have few tangible assets and may take years to become profitable.

National Fragmentation: The EU's single market remains incomplete, particularly in financial services, creating barriers to cross-border investment and market integration. This fragmentation leads to smaller pools of private capital and less efficient resource allocation, which in turn hampers the ability of VC funds to grow and support later-stage startups.

Limited Scale: The VC industry in the EU is characterized by smaller funds and fewer large-scale exits. This limits the availability of growth capital for startups and incentivizes successful firms to seek funding and eventual exits outside of Europe, often in the US, where markets are deeper and more integrated.

Regulatory Hurdles: Existing EU regulations, such as Solvency II for insurers, impose significant constraints on institutional investors' ability to invest in VC, further limiting the capital available for high-growth startups. Additionally, differences in national tax and legal systems create inefficiencies and reduce cross-border investment.

Overall, the European risk-averse mindset of regulating instead of innovating creates multiple barriers for the venture capital industry (as well as the other verticals)!

Innovation Financing Ecosystem

Source: IMF

The report offers several key recommendations to strengthen the European venture capital ecosystem:

Enhance Public Support: Expand the role of public financial institutions (PFIs) like the European Investment Fund (EIF) to bridge the gap in VC funding, particularly in early-stage and scale-up investments. PFIs can play a catalytic role by providing capital and attracting private investors through co-investment and funds-of-funds models.

Regulatory Reform: Align regulatory frameworks across the EU to reduce barriers to investment in VC. This includes revisiting the Solvency II regulations to make it easier for insurers to invest in VC and harmonizing tax treatments across member states to encourage cross-border investments.

Market Integration: Accelerate efforts to create a truly integrated single market for goods, services, labor, and capital. This would include further consolidation of stock markets and harmonization of insolvency regimes, which are essential for improving exit opportunities and attracting more VC investments.

Education and R&D Investments: Strengthen the foundations for innovation by increasing investments in education, R&D, and ICT. This will ensure that the EU can generate and scale the high-growth startups necessary to compete globally.

In summary, the report underscores the urgency of developing a more robust venture capital ecosystem in Europe. By addressing structural barriers, enhancing public and private investment synergies, and deepening market integration, Europe can unlock the full potential of its startups, driving innovation, job creation, and economic growth.

The recommendations provided are a call to action for policymakers, investors, and entrepreneurs to work together in building a more dynamic and globally competitive European venture capital industry.

For a detailed analysis and to explore the full set of recommendations, download the report here.